The Korean Wave

Hallyu, a term we may not be familiar with by name but certainly are by output, is a Chinese word literally translating as “Korean Wave”. It refers to the transcendence and increasing popularity of South Korean cultural exports, firstly picked up by countries such as China and Japan, and now more recognisably across Western countries too.

Today, the South Korean culture influences most consumer goods categories, from skincare to our choice of snacks. And it’s not simply products that consumers are engaging with. Our datasets show significant engagement in conversation around ingredients and benefits of this cross-category trend, supported with a rise of popularity in Korean brands and even retailers making their way to our shores.

In May 2019, Korean supermarket Oseyo announced the opening of its fifth store in London. As well as selling a range of Asian food such as kimchee, noodles and mochi, it will stock popular imported Korean cosmetics, K-pop albums and Korean household appliances.

What kick started the trend?

What kick started the trend?

Clearly consumer demand for all things Korean is at an all-time high. But why has the South Korean culture trend become so popular in the Western world? And what started it?

A phrase coined by Beijing journalists, Hallyu started during the financial crisis of 1997. South Korea began restricting cultural imports from Japan, which then led to a cultural void of sorts.

South Korea’s Ministry of Culture embarked on a mission to strengthen local culture within Korea and build on their own talents. This saw the government invest heavily in the creative industries, creating 300 culture-based departments in universities across Korea.

Studios began producing high-quality Korean films and K-dramas very cheaply. These addictive dramas started airing in China before sweeping across the Western world. This was the start of Hallyu spreading globally, piquing the curiosity and capturing the imagination of the 90s generation.

K-Pop

K-Pop

Then thanks to social media and the explosion of YouTube, the South Korean culture was propelled onto the global mainstage through the medium of K-pop. With its catchy sounds, edgy fashion and carefully choreographed dance routines, it soon attracted global fans.

But Hallyu isn’t limited to TV and music. South Korean fashion, games, comics, food, alcohol and cosmetics are all sweeping across the world.

K-Beauty

K-Beauty

The most recent trend that is rocketing worldwide is K-Beauty. Consumers want the pristine skin of Korean celebrities. With the emphasis on ‘functional cosmetics’, the Korean beauty industry doesn't shy away from introducing new, innovative and sometimes bizarre ingredients to their formulas that would never have previously been considered in the West. But this is all changing.

The Korean beauty market is now among the top 10 around the world. According to global market intelligence agency Mintel, in 2018 it was estimated to be worth over $13.1 billion in sales. Our data supports this estimation, with a significant number of top growing products and ingredients evolving out of the Hallyu trend.

As an example, Asian beauty ingredient Centella Asiatica has a Trend Prediction Ranking (TPV) of 10 out of 2329* ingredients. TPV is our proprietary scientific ranking metric that helps brands identify which trends to prioritise for innovation. It assigns a comparative value to each of the thousands of conversation trends taking place within a category, enabling trends to be objectively ranked based on their predicted importance. With such a high ranking, the data predicts sustained growth of the Centella Asiatica trend over the next year and should be one to take note of in the beauty category.

But what’s next and how can you ride the wave?

But what’s next and how can you ride the wave?

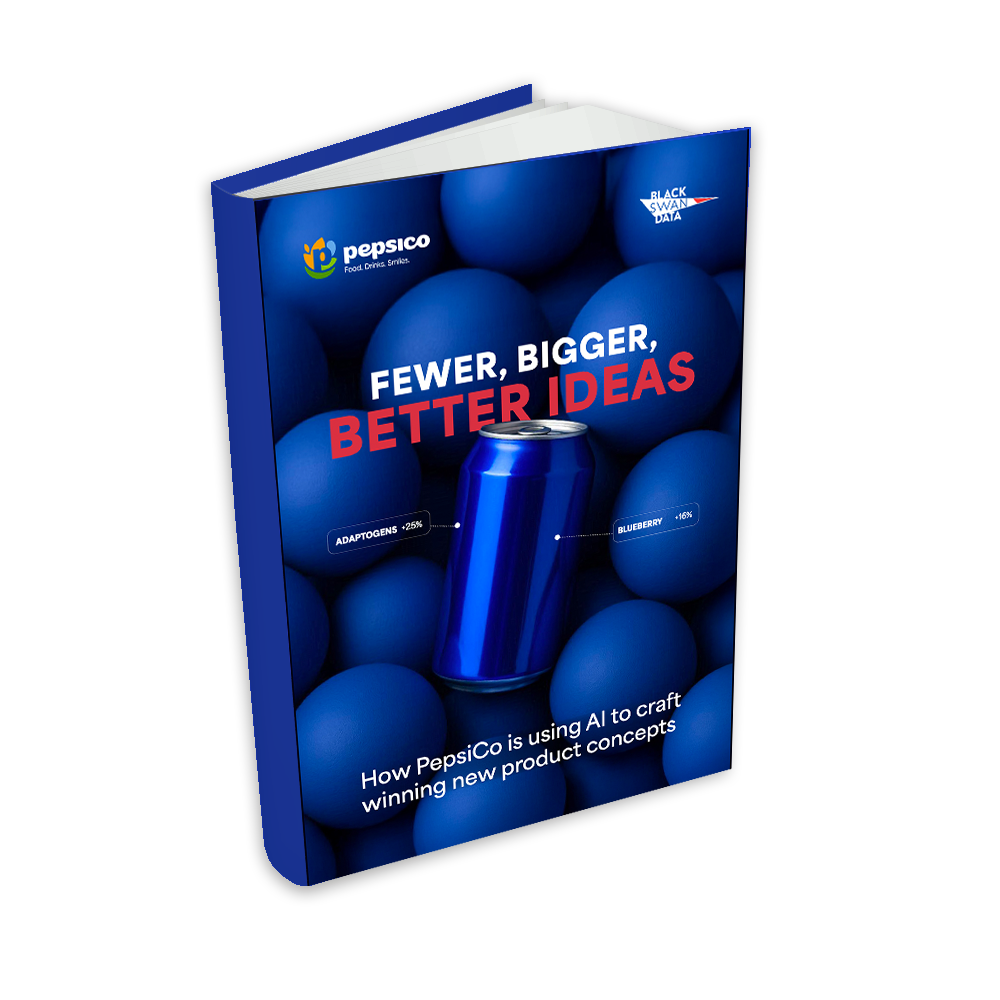

For global manufacturers of cosmetics, food and beverage products there is clearly huge opportunity to take advantage of this consumer trend now, but which other Korean influenced themes, products and ingredients are likely to trend in the future?

Look no further than our Hallyu cross-category report, which brings insight and foresight about innovation opportunities within Korean Skincare, Snacking, Beverages and Alcohol.

Download the report here.

*The data in this blog is from Black Swan’s Global Skincare dataset, updated to 31st May 2019.

What kick started the trend?

Clearly consumer demand for all things Korean is at an all-time high. But why has the South Korean culture trend become so popular in the Western world? And what started it?

A phrase coined by Beijing journalists, Hallyu started during the financial crisis of 1997. South Korea began restricting cultural imports from Japan, which then led to a cultural void of sorts.

South Korea’s Ministry of Culture embarked on a mission to strengthen local culture within Korea and build on their own talents. This saw the government invest heavily in the creative industries, creating 300 culture-based departments in universities across Korea.

Studios began producing high-quality Korean films and K-dramas very cheaply. These addictive dramas started airing in China before sweeping across the Western world. This was the start of Hallyu spreading globally, piquing the curiosity and capturing the imagination of the 90s generation.

What kick started the trend?

Clearly consumer demand for all things Korean is at an all-time high. But why has the South Korean culture trend become so popular in the Western world? And what started it?

A phrase coined by Beijing journalists, Hallyu started during the financial crisis of 1997. South Korea began restricting cultural imports from Japan, which then led to a cultural void of sorts.

South Korea’s Ministry of Culture embarked on a mission to strengthen local culture within Korea and build on their own talents. This saw the government invest heavily in the creative industries, creating 300 culture-based departments in universities across Korea.

Studios began producing high-quality Korean films and K-dramas very cheaply. These addictive dramas started airing in China before sweeping across the Western world. This was the start of Hallyu spreading globally, piquing the curiosity and capturing the imagination of the 90s generation.

K-Pop

Then thanks to social media and the explosion of YouTube, the South Korean culture was propelled onto the global mainstage through the medium of K-pop. With its catchy sounds, edgy fashion and carefully choreographed dance routines, it soon attracted global fans.

But Hallyu isn’t limited to TV and music. South Korean fashion, games, comics, food, alcohol and cosmetics are all sweeping across the world.

K-Pop

Then thanks to social media and the explosion of YouTube, the South Korean culture was propelled onto the global mainstage through the medium of K-pop. With its catchy sounds, edgy fashion and carefully choreographed dance routines, it soon attracted global fans.

But Hallyu isn’t limited to TV and music. South Korean fashion, games, comics, food, alcohol and cosmetics are all sweeping across the world.

K-Beauty

The most recent trend that is rocketing worldwide is K-Beauty. Consumers want the pristine skin of Korean celebrities. With the emphasis on ‘functional cosmetics’, the Korean beauty industry doesn't shy away from introducing new, innovative and sometimes bizarre ingredients to their formulas that would never have previously been considered in the West. But this is all changing.

The Korean beauty market is now among the top 10 around the world. According to global market intelligence agency Mintel, in 2018 it was estimated to be worth over $13.1 billion in sales. Our data supports this estimation, with a significant number of top growing products and ingredients evolving out of the Hallyu trend.

As an example, Asian beauty ingredient Centella Asiatica has a Trend Prediction Ranking (TPV) of 10 out of 2329* ingredients. TPV is our proprietary scientific ranking metric that helps brands identify which trends to prioritise for innovation. It assigns a comparative value to each of the thousands of conversation trends taking place within a category, enabling trends to be objectively ranked based on their predicted importance. With such a high ranking, the data predicts sustained growth of the Centella Asiatica trend over the next year and should be one to take note of in the beauty category.

K-Beauty

The most recent trend that is rocketing worldwide is K-Beauty. Consumers want the pristine skin of Korean celebrities. With the emphasis on ‘functional cosmetics’, the Korean beauty industry doesn't shy away from introducing new, innovative and sometimes bizarre ingredients to their formulas that would never have previously been considered in the West. But this is all changing.

The Korean beauty market is now among the top 10 around the world. According to global market intelligence agency Mintel, in 2018 it was estimated to be worth over $13.1 billion in sales. Our data supports this estimation, with a significant number of top growing products and ingredients evolving out of the Hallyu trend.

As an example, Asian beauty ingredient Centella Asiatica has a Trend Prediction Ranking (TPV) of 10 out of 2329* ingredients. TPV is our proprietary scientific ranking metric that helps brands identify which trends to prioritise for innovation. It assigns a comparative value to each of the thousands of conversation trends taking place within a category, enabling trends to be objectively ranked based on their predicted importance. With such a high ranking, the data predicts sustained growth of the Centella Asiatica trend over the next year and should be one to take note of in the beauty category.

But what’s next and how can you ride the wave?

For global manufacturers of cosmetics, food and beverage products there is clearly huge opportunity to take advantage of this consumer trend now, but which other Korean influenced themes, products and ingredients are likely to trend in the future?

Look no further than our Hallyu cross-category report, which brings insight and foresight about innovation opportunities within Korean Skincare, Snacking, Beverages and Alcohol.

But what’s next and how can you ride the wave?

For global manufacturers of cosmetics, food and beverage products there is clearly huge opportunity to take advantage of this consumer trend now, but which other Korean influenced themes, products and ingredients are likely to trend in the future?

Look no further than our Hallyu cross-category report, which brings insight and foresight about innovation opportunities within Korean Skincare, Snacking, Beverages and Alcohol.