Kombucha tea anyone? Or maybe a turmeric shot? An increasing number of consumers are taking a proactive approach to their health and wellbeing, but not necessarily in the traditional formats we have become used to.

Whilst the consumption of vitamins and supplements is still increasing, consumers are also opting for a more holistic approach to a healthy lifestyle, blurring the lines between food, drink, and conventional supplement use. As more consumers are considering new and varied methods to support immunity, mental health, and their appearance, brands must adapt to these changing behaviours.

New opportunities

Using our new Vitamins and Supplements dataset, we’ve taken a deep dive into three major shifts that are occurring within the category, enabling you to identify the future growth drivers and consequently choose the right trends to innovate and activate for 2022+.

Trend prediction quickly explained

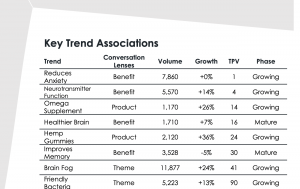

You’ll see we’ve used our Trend Prediction Value (TPV) to rank the trends below. TPV is a scientific metric that ranks the thousands of conversation trends we’re continuously tracking by their future growth potential. Put simply, the higher the TPV ranking, the higher certainty that this trend will be growing in consumer conversation in 6-18 months. It enables brands to spot future growth opportunities earlier, and use a scientific measure to prioritise which trends to action in their innovation and marketing strategies.

You can find out more about

TPV and our Social Prediction tool,

Trendscope here.

Immunity: Today and Tomorrow

Due to Covid, consumers’ search for immunity support has significantly accelerated their daily use of vitamins and supplements.

With a 146% increase in conversation around both proactive and reactive immunity solutions, it appears that consumers are not only searching for immediate benefits but also considering how they can optimise their health for the future.

Considering nutrient needs within the context of diet and exercise consumers want to complement their supplement intake with a healthy, varied diet and physical activity.

Where to focus

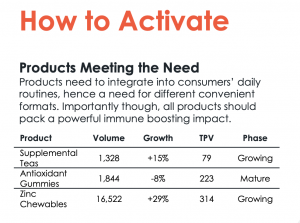

Brands need to innovate and plan for the needs of tomorrow taking a holistic approach and focussing on the optimisation of health.

Sweeping and general ‘immunity’ claims will need to give way to specific, focused products that leverage the hero ingredients consumers are seeking.

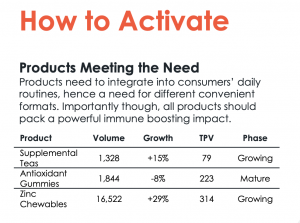

Consumers want products that guarantee an impact, delivered through convenient formats and fit daily routines and lifestyles. Brands will need to present a variety of formats from chewables (TPV 382, Mature) and gummies (223, Mature) to tea (79, Growing), each one suiting the individuals need or occasion.

Product efficacy will be paramount. Brands should strive to deliver science-backed products that are marketed with a hero ingredient and use language supporting the strength and reliability of said ingredient. Bioavailability and easy absorption have become key factors in both quality and efficacy with consumers looking for claims of fast absorbing (TPV 33, Growing) and micronized (10, Growing) as indicators of this.

In summary, today’s consumer desires products and evidence that guarantee an impact, delivered through convenient formats that fit daily routines and lifestyles.

Beauty Innovation

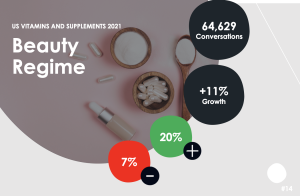

The pandemic has given many a chance to revisit their

skincare regimes and take a more proactive approach to their daily routines.

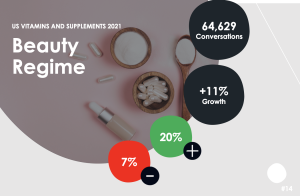

With 11% growth in conversation, beauty is a fast-emerging frontier within the vitamins and supplements space. Naturally, the influence of adjacent hair and skincare categories is strong, and brands need to be aware of the trends that start and transcend here.

Consumers who previously relied on traditional beauty products to maintain their appearance are now looking at vitamins and supplements to enhance their appearance as part of their overall well-being. As many shift their focus towards a more holistic approach to beauty and health, brands and companies need to ensure that they are looking at their products and services with the same view.

Where to focus

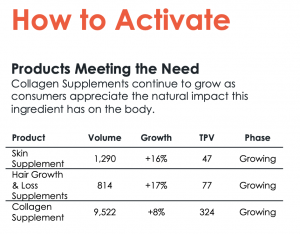

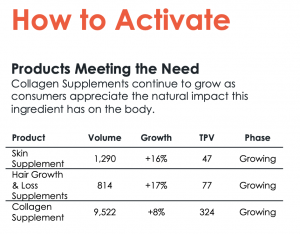

Hair health and growth remain key concerns for men and women, as they continue to search for supplements they can rely on. Opportunities lies in preventative solutions that harness natural ingredients and target the specific needs of hair health through science-backed ingredients.

As mentioned, the influence from hair and skin care categories is strong in this space. Brands need to stay abreast of new trends occurring in adjacent sectors and leverage these by drawing on synergies and ingredient equity.

An increase in younger consumers considering beauty supplements is also providing new opportunities within the category. More are taking proactive measures to maintain and support their appearance, skin and hair.

This new, younger audience is on the lookout for permanent solutions to problems like acne (TPV 111, Mature) and skin hydration (289, Growing) and as they advance in age, a shift in focus towards improving hair health (3, Growing) and preventing wrinkles (168, Dormant).

Mental Health and Acuity

How can brands support consumers’ mental health post-pandemic?

With mental health becoming even more of a priority due to the turbulence of the past year, consumers are taking a more proactive approach to supporting their mental wellbeing alongside their physical health.

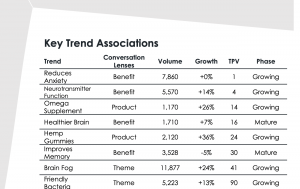

With a 20% growth in conversation, consumers are turning to a new holistic approach to their health, aligning with our other macrotrends in this category. Mental support to facilitate goals, recovery, performance and physical maintenance of cognitive function are all on the rise.

Where to focus

Consumers are beginning to place scrutiny on the ingredient lists opting for simple products with few ingredients that are natural and of the highest quality.

Brands need to adopt a transparent and informative approach, helping consumers to understand what they’re paying for and why the investment is worthwhile. Clear labelling is a necessity whilst providing an educational approach as to what is in the product and why.

Whilst mental wellness is the primary focus for consumers in this space, value is highly placed when benefits are combined to support overall health. Marketing products that support both mental function and physical benefits to the rest of body e.g., probiotics, is integral. Products should be tackling the connected physical (brain function) and mental needs concurrently.

Consumers find mental health supplements an inviting proposition but don’t know how to confirm they work. Brands should position these as part of healthy, mindful living, ensuring products become facilitators, not short cuts.

When the physical benefit isn’t tangible, focus on lifestyle or progress beyond the category. For example, feelings of more productivity, happiness or sleeping better reaffirm product success and is evidenced through adoption of a holistic healthy lifestyle.

For example, brands such as Moon Juice provide consumers with accessible ingredient and benefit information. Their formulas tackle issues around stress, mood support and brain function, targeting those consumers who want to take a more proactive approach to ensuring their mental wellbeing.

How can our data help you?

Developing robust business strategies and ensuring a continuous stream of meaningful innovation within the pipeline is easy, right? Well, not quite. Marketing and Innovation teams are constantly challenged with predicting what trends are here to stay, and which are mere fads, now more than ever.

At Black Swan Data every trend we surface is organised into our proprietary Innovation Lens framework. Innovation Lenses allow us to identify and analyse all the trends within a particular area (e.g. benefit claims, products, ingredients, occasions, etc.) to understand how they compare and interrelate. We can then analyse them using techniques like network clustering to understand how similar trends ladder-up into macro growth drivers.

To dive even deeper into our predictions, you can download our

Vitamins and Supplements Prediction Report 2021 or alternatively, if you have specific questions, one of our team would be happy to

arrange a call.