Black Swan’s new Covid Classifier explained

The pitfalls of analysing consumer behaviour in a pandemic

What is going to happen in the future? How can I be sure that the investment decisions we make as a company – whether that’s launching a new product, or spending more marketing dollars on a new campaign, will pay off? How can I make better decisions to ensure my company grows?

These are questions that every business leader has asked since the beginning of time, and they are one of the primary reasons why the field of Market Research was created. All market research activity, whether it’s a survey, or a focus group, or a Marketing Mix Model carries with it the implicit promise that whatever behaviour or attitude is uncovered in the research is representative of future behaviour. I.e. if a survey says that consumers like Cherry Flavoured Cola today, then in a few months or a year when I launch a Cherry Flavoured Cola, I assume that they will still like it and buy it.

There are many challenges with traditional research methods that we’ll go into in future posts, but setting those aside for a moment, even companies that believe the results from traditional research methods have times when they do not conduct research. One example of those times is the Christmas holiday period. Back when I was an Insight Director at PepsiCo, we would have ‘blackout’ periods over the holidays where we would not conduct any research. The reason we did this is because that initial implicit promise – that answers and behaviour collected in surveys and other traditional techniques would be indicative of future behaviour – we knew was

not true. During Christmas time, consumers behave differently – they buy different things, they have different patterns, and so asking questions during this time can lead to false conclusions that don’t play out in the rest of the year.

This period of ‘abnormal’ behaviour only lasts a couple of weeks a year, and so not doing any research during this time wasn’t too big of a disruption to the normal flow of business decision making. But since the world went into lockdown due to Coronavirus, consumers have been behaving differently. This was summed up perfectly by a recent soundbite I heard:

“Most companies don’t do research around the holiday season because it’s not normal behaviour...Covid-19 is like the holiday season x1000.”

Covid paralysis: Do nothing vs gut feel?

CPGs have stopped most primary research activity because they are worried about trusting the results they would get back from those surveys and focus groups. Why spend research dollars on research you can’t trust? The problem is this blockage has in turn had the effect of putting a ‘dark cloud’ on all of the decision making happening. Companies that are used to having data and research to inform and give them confidence in their decision making now have had to make-do without. This has led most firms into one of the following scenarios:

- Some are in paralysis mode – not moving forward with new product plans or major marketing efforts.

- Some are going back to ‘gut feel’ decision making and moving forward on major decisions without any data.

- Some are starting Traditional primary research again – despite the problems they know about that caused them to stop doing it earlier in the year.

- And some are seeking out new techniques to help inform their decision making with data during this challenging period.

Decision making is a difficult business at the best of times, but each of these scenarios are fraught with their own dangers:

- Staying in paralysis mode, hunkering down, hoping the storm will pass – these pathways can make sense in the short term, but they don’t lead to company growth. Evidence from McKinsey suggests that those that move forward with innovation and continue to invest in downturns come out on the other side as leaders in the market place. Rarely has a business cost-cut its way to growth.

- Going back to ‘gut feel’ isn’t always a bad thing. There is certainly a danger of being paralysed from having too MUCH data. However, when it comes to spending millions of dollars on a new product launch or marketing campaign - if that decision doesn’t pan out and the launch doesn’t go to plan, how comfortable do you feel explaining your gut to the board?

- Starting Primary research again has other unique problems – and this is more to do with a potentially false sense of confidence that would be gained from those survey results.

The challenge: Separate the signal from the noise

At Black Swan Data, we are in the business of predicting consumer behaviour, and we are often asked: ‘How do you know which trends will continue post Covid, and which ones are fads that will fade away?” It’s not an easy question to answer, but we have a number of benefits on our side.

Firstly, we have comprehensive, longitudinal, category datasets containing over 2 years of raw online consumer conversation – so we can understand the trends both before and during Covid. We have built 45+ detailed category and market datasets with hundreds of thousands of trends, tracking not just broader topics, but thousands of brands, product types, ingredients, benefits, and themes in each category.

Secondly, we have a strong

prediction capability, where we can forecast underlying trend volume and growth 6 months into the future with 89% accuracy.

With this foundation, we set about finding a scientific way by which we could adjust our forecasts to filter out the noise coming from this abnormal period and ensure we only prioritise the trends that will sustain.

What is the Covid Classifier?

Simply put, for every trend in our datasets, we have identified which Covid-driven conversations have resulted in long-term, normalised behaviour change. And we can adjust for this behaviour even when people stop mentioning Covid specific terms. Important when you consider only 1 in 5 Covid related conversations contain obvious pandemic terms like ‘coronavirus’ or ‘lockdown’.

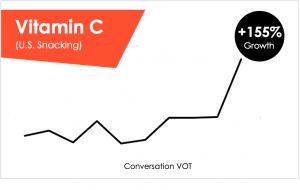

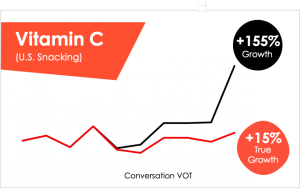

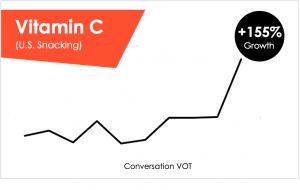

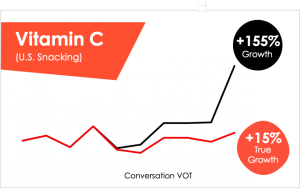

To pick an obvious example, people seeking ways in which to potentially protect themselves from the virus or to alleviate its effects have turned to foods and supplements fortified with Vitamin C. Within Snacking we saw conversations surrounding this topic grow +155% versus before Covid.

On face value this is useful insight for marketeers and product innovators who will be thinking about how they can add Vitamin C to their next formulation upgrade and upweight claims about it on their packaging and POS materials. However, can this data be trusted to be a true account of a lasting change in consumer attitude?

We are able to remove the influence of Covid, 'the noise', by filtering out posts and content which are explicitly fuelled by the pandemic to unearth the 'true' underlying changes to consumer behaviour. Even in cases like “Vitamin C” above, where Covid has been the catalyst for this change. After the Covid Classifier has been applied - we can see the accurate growth of Vitamin C conversations in Snacking is far more modest at +15%.

Our proprietary trend prediction algorithm reads this new information and adjusts its forecast accordingly. Meaning outputs and recommendations from our

Trendscope and

Horizon solutions will not be side-tracked by fads, and instead prioritise sustained, long term consumer trends that you can bet your innovation dollars on.

So how did we do it?

There are two parts to the process. It starts with our Data Foundation: the thousands of behavioural trends we track across the 2 year + history, and our scientific forecasting model. From there, our Data Science teams worked tirelessly to build a Covid-Sensitive Classification Model.

How to Train a Covid-Sensitive Classification Model:

- Humans start with the Covid terms. Like anyone can, we begin with a Covid Taxonomy of search terms like "coronavirus", "covid", "pandemic", etc.

- We read between the lines to find topics using data science, identifying a vast array of posts that are specifically pandemic-related and a random pre-pandemic sample that are not to form a training dataset.

- When training the Covid Classifier we hide all the original pandemic terms ("coronavirus", "covid", "pandemic", etc) forcing the model to learn from context (groups of words and phrases).

- The result is a robust model that can identify a wide array of content driven by the pandemic which we can then use to filter our data and unearth the real consumer trend.

To train the Covid Classifier, we hide the Covid Taxonomy terms, e.g. words like "pandemic", so the machine is forced to learn which contexts are influenced by Covid.

Lift the dark cloud; unlock future growth

To train the Covid Classifier, we hide the Covid Taxonomy terms, e.g. words like "pandemic", so the machine is forced to learn which contexts are influenced by Covid.

Lift the dark cloud; unlock future growth

With this new Covid Classifier we are helping companies lift the dark cloud of uncertainty that is slowing down innovation and marketing activities, by giving them robust, objective, forward-looking data and recommendations from which to base their decision making and 2021+ strategy planning on.

Recessions are tough. But they also represent a great opportunity. Companies that can understand and foresee what will be relevant to consumers going forward, will invest in the right innovation programme, the right communications strategy, and grow market share when others are paralysed and frightened.

Our world-leading trend datasets track thousands of category and market specific trends, providing the richest and most comprehensive view of consumer conversation. Our Trend Prediction Value algorithm provides an objective, accurate priority list of which trends will grow fastest in the future. And now with the Covid Classifier enhancement, you can be rest assured that the strategic recommendations we make to drive your Innovation Platforms, Category Strategy, and Marketing Communications are Covid-proof.

By

David Soderberg, Chief Data Officer and

Markus Frise, Director of Data Science.

To request the true Covid-filtered growth of a trend or topic that’s important in your category, or to book a short demonstration of our Horizon and Trendscope solutions, please contact us here.

Or read more here about how the Covid Classifier can prevent insight and innovation teams from flying blind by Hugo Amos (Black Swan’s Co-Founder).

On face value this is useful insight for marketeers and product innovators who will be thinking about how they can add Vitamin C to their next formulation upgrade and upweight claims about it on their packaging and POS materials. However, can this data be trusted to be a true account of a lasting change in consumer attitude?

We are able to remove the influence of Covid, 'the noise', by filtering out posts and content which are explicitly fuelled by the pandemic to unearth the 'true' underlying changes to consumer behaviour. Even in cases like “Vitamin C” above, where Covid has been the catalyst for this change. After the Covid Classifier has been applied - we can see the accurate growth of Vitamin C conversations in Snacking is far more modest at +15%.

On face value this is useful insight for marketeers and product innovators who will be thinking about how they can add Vitamin C to their next formulation upgrade and upweight claims about it on their packaging and POS materials. However, can this data be trusted to be a true account of a lasting change in consumer attitude?

We are able to remove the influence of Covid, 'the noise', by filtering out posts and content which are explicitly fuelled by the pandemic to unearth the 'true' underlying changes to consumer behaviour. Even in cases like “Vitamin C” above, where Covid has been the catalyst for this change. After the Covid Classifier has been applied - we can see the accurate growth of Vitamin C conversations in Snacking is far more modest at +15%.

Our proprietary trend prediction algorithm reads this new information and adjusts its forecast accordingly. Meaning outputs and recommendations from our

Our proprietary trend prediction algorithm reads this new information and adjusts its forecast accordingly. Meaning outputs and recommendations from our  To train the Covid Classifier, we hide the Covid Taxonomy terms, e.g. words like "pandemic", so the machine is forced to learn which contexts are influenced by Covid.

Lift the dark cloud; unlock future growth

With this new Covid Classifier we are helping companies lift the dark cloud of uncertainty that is slowing down innovation and marketing activities, by giving them robust, objective, forward-looking data and recommendations from which to base their decision making and 2021+ strategy planning on.

Recessions are tough. But they also represent a great opportunity. Companies that can understand and foresee what will be relevant to consumers going forward, will invest in the right innovation programme, the right communications strategy, and grow market share when others are paralysed and frightened.

Our world-leading trend datasets track thousands of category and market specific trends, providing the richest and most comprehensive view of consumer conversation. Our Trend Prediction Value algorithm provides an objective, accurate priority list of which trends will grow fastest in the future. And now with the Covid Classifier enhancement, you can be rest assured that the strategic recommendations we make to drive your Innovation Platforms, Category Strategy, and Marketing Communications are Covid-proof.

By

To train the Covid Classifier, we hide the Covid Taxonomy terms, e.g. words like "pandemic", so the machine is forced to learn which contexts are influenced by Covid.

Lift the dark cloud; unlock future growth

With this new Covid Classifier we are helping companies lift the dark cloud of uncertainty that is slowing down innovation and marketing activities, by giving them robust, objective, forward-looking data and recommendations from which to base their decision making and 2021+ strategy planning on.

Recessions are tough. But they also represent a great opportunity. Companies that can understand and foresee what will be relevant to consumers going forward, will invest in the right innovation programme, the right communications strategy, and grow market share when others are paralysed and frightened.

Our world-leading trend datasets track thousands of category and market specific trends, providing the richest and most comprehensive view of consumer conversation. Our Trend Prediction Value algorithm provides an objective, accurate priority list of which trends will grow fastest in the future. And now with the Covid Classifier enhancement, you can be rest assured that the strategic recommendations we make to drive your Innovation Platforms, Category Strategy, and Marketing Communications are Covid-proof.

By