Well, this is embarrassing…

I started Black Swan Data because I believed AI applied to big data could help global CPG brands with one of their biggest challenges – uncertainty. Whilst Black Swan was never created to try and predict a pandemic, the name certainly raises some questions when we are faced with what is likely to turn out to be one of the biggest ‘Black Swan’ events of our lives. Hindsight is a powerful thing. That said, what Black Swan do is accurately predict consumer trends, which pandemics will in turn naturally impact and change.

Therefore, our teams have been working around the clock to help our clients filter through the noise and get at what matters, faster.

Uncertainty and growth in CPG

Even before the pandemic, consumers buying and consumption habits were continuously changing and becoming more fragmented. Tastes, preference, and dietary requirements were fast evolving, as were consumer values around consumption, and what that meant in terms of consumers’ favoured brands.

Social media fanned the flames, driving these trends across borders and cultures, making them accelerate faster and further than before. Some were disappearing as fast as they appeared (remember the cronut anyone?), whereas others were sticking round a bit longer. Knowing which trends to back, and when, was a minefield to manufacturers with lengthy innovation cycles and complex supply chains.

This unpredictability has limited companies’ ability to grow. In McKinsey & Co’s paper titled ‘

What got us here, won’t get us there’, they show that even the small profit improvements the top 30 CPG firms have experienced over the last ten years, has been driven by reducing costs and improving margin, rather than from any significant top line growth.

Sadly, this story was particularly true for larger brands, who showed a 1.5% reduction in YOY unit sales, versus high growth, challenger brands. Put simply – larger brands have found it tricky to keep up with nimbler, niche competitors who use their speed, direct consumer connections and data to better tap into shifting consumer attitudes and trends.

Along came Covid-19…

Covid-19 has compounded the situation. When this pandemic hit, consumers decided to throw their longer term (slightly more predictable) behaviours like ‘clean eating’ out the window and almost overnight, become impossible to track. The unpredictability of these behaviours has been worrying for CPG firms and unsurprisingly, as a result, resources and investments earmarked for long-term innovation and 2021+ planning has suffered.

Whilst I can understand why innovation feels risky in a world of uncertainty and that focusing on the core business feels more secure, I worry that this playing it safe behaviour risks becoming short-sighted and will make the growth challenge for larger brands worse.

Evidence from

McKinsey’s analysis of the 2009 financial crisis backs this view. They found that organisations who maintained their innovation focus emerged stronger, outperforming the market average by more than 30 percent. It does not stop there. These companies also continued to benefit from this investment, delivering accelerated growth over the next three to five years.

Understanding consumer behaviour in a pandemic

The problem is CPGs are no longer equipped with the right tools to analyse, understand and prioritise which changes in consumer behaviour they should act upon. Traditional research methods of asking people direct questions are flawed. People are preoccupied with more pressing concerns in their lives right now – like ‘will I have an income next month?’ - that skew their responses. The result: misleading insights that can lead your organisation down the wrong path.

Most companies are aware of these issues and as a result have frozen their research programmes. But when timely, accurate and proprietary consumer insight is the lifeblood of your organisation, what are the impacts of this paralysis on future growth? Marketing and Innovation teams are effectively flying blind right now - can you relate?

How Black Swan’s Covid Classifier can help

Black Swan’s Social Prediction capability analyses what consumers are organically talking about online and then applies a trend prediction algorithm to give our clients a scientific metric by which to prioritise new and emerging trends for first-mover advantage.

The higher the TPV rank, the higher the likelihood the topic will grow in relevance over the next 6-18 months. It enables forward-thinking companies like PepsiCo, Danone and Colgate Palmolive to look at their consumers in a different way, and therefore innovate and communicate more effectively. However, for said reasons, our data is not immune to the impact of Covid with online chatter dominated by the pandemic over the last 6 months.

Responding to this challenge, we wanted to arm our clients with a powerful approach for analysing this new landscape. So, our teams have been working tirelessly to use our data science capabilities to identify and filter out Covid-19 fuelled conversations so that we can reduce the impact of artificial growth spikes and cut through the noise. It means our recommendations are Covid-proof, identifying and promoting only the trends that will sustain through, and beyond, the pandemic.

What’s the true growth?

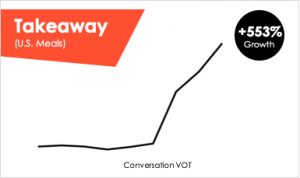

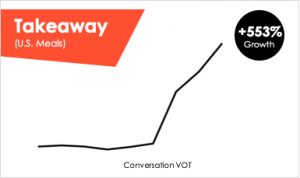

As proof let’s look at an obvious example. Food delivery services witnessed a surge in take-up and sales throughout lockdown. Bored of the daily routine and cooking at home, people who had never previously done so before, took to GrubHub, Uber Eats and others to bring variety and excitement to their mealtimes. As such we saw huge growth in conversation volume, + 553%, of people talking about Takeaway online.

However, will this behaviour sustain and accelerate in the future? And as a food and drink manufacturer should I be altering my strategy on account of this? The situation becomes clearer with the Covid Classifier applied. If we filter out the conversations that are Covid-driven to understand the trend’s true underlying growth, we can see that whilst there is still a sizeable increase (+54% versus pre-Covid) the growth figures are not so impressive. As such our trend prediction algorithm will downgrade this trend in its ranking accordingly.

Read here

Read here for a more detailed description about how our Covid Classifier and trend prediction methodology works.

We are pleased to be rolling out the Covid Classifier across our clients and look forward to helping them get back to the business of creating breakthrough innovations that fuel top line growth. Because of this, our clients will be the companies who continue to innovate through the crisis, and who will emerge much stronger as a result.

Should you get in touch?

As consumers preferences, attitudes and needs continue to change fast, ask yourself this: is your company investing in the tools and capabilities that will help you accurately identify these changes? At the speed they are occurring? And prioritise which ones will matter most to consumers in the future?

If not, let us help you. Do not let your organisation fly blind, miss these opportunities, and risk slipping further behind.

By

Steve King, CEO and Co-Founder

To request the true Covid-filtered growth of a trend or topic that’s important in your category, or to book a short demonstration of our Horizon and Trendscope solutions, please contact us.

However, will this behaviour sustain and accelerate in the future? And as a food and drink manufacturer should I be altering my strategy on account of this? The situation becomes clearer with the Covid Classifier applied. If we filter out the conversations that are Covid-driven to understand the trend’s true underlying growth, we can see that whilst there is still a sizeable increase (+54% versus pre-Covid) the growth figures are not so impressive. As such our trend prediction algorithm will downgrade this trend in its ranking accordingly.

However, will this behaviour sustain and accelerate in the future? And as a food and drink manufacturer should I be altering my strategy on account of this? The situation becomes clearer with the Covid Classifier applied. If we filter out the conversations that are Covid-driven to understand the trend’s true underlying growth, we can see that whilst there is still a sizeable increase (+54% versus pre-Covid) the growth figures are not so impressive. As such our trend prediction algorithm will downgrade this trend in its ranking accordingly.