Hard Seltzer’s growth to $5bn sales in a little over five years has been nothing short of spectacular, but could it have been predicted? And what’s next in the rapid evolution of this fast-growing category? These are the questions we set out to answer in the following analysis.

What are Hard Seltzers?

Hard Seltzers are a mix of sparkling water, fruit flavours and alcohol. Appealing to a younger generation of drinkers and buoyed by social media fame, they’ve taken the market by storm, delivering triple digit sales increases year-on-year, and causing widespread stock shortages in the summers of 2018 and 2019. Despite a recent slowdown in sales and increased competition from established Alcohol brands entering the category, the White Claw and Truly brands maintain dominance with a 75% market share. Launched in 2016, both were new to the scene but gained a massive competitor advantage by being first to leverage emerging consumer needs and become synonymous with the category’s rise. But could this explosion in consumer demand for Hard Seltzers have been predicted?

Putting our data to the test

Trendscope is a consumer intelligence tool that uses AI to ingest, analyse and connect the conversation topics that millions of consumers are actively talking about online. It turns this analysis into a powerful longitudinal understanding of consumer behaviour and predicts what’s next with an 89% trend prediction accurate rating. To put it to the test, we went back to data from 2016, when White Claw was first launched, to analyse conversations surrounding the Alcoholic Beverage space.

What we found

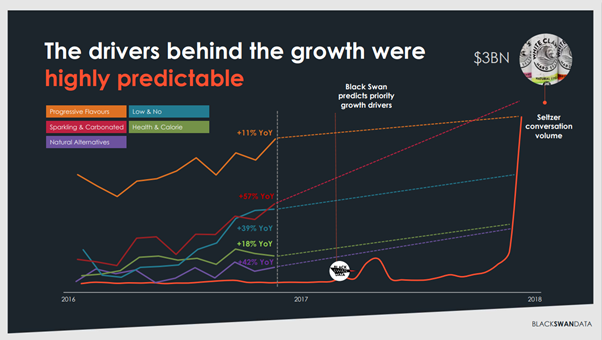

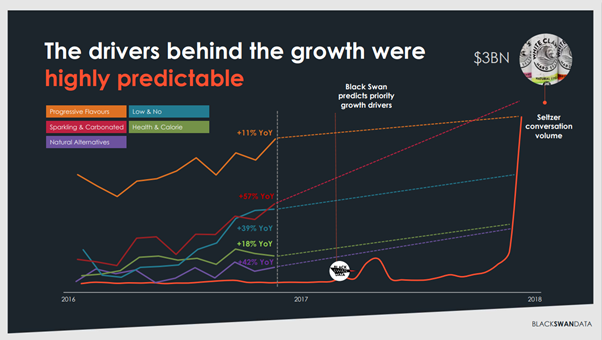

Looking back, we can clearly see the emergence and convergence of several key powerful trends and need states that the burgeoning Hard Seltzer category was able to successfully address: Progressive Flavours (+11% Year on Year) - The largest conversation topic in terms of volume, younger drinkers were turning away from sickly-sweet alco-pops and looking for more sophisticated, infused adult-like flavours. Sparkling & Carbonated (+57%) - The fastest growing territory and clearly influenced by the rise in popularity of brands like LaCroix in Non-Alcoholic Beverages. Consumers were still looking for a carbonated sensation, but in a drink that was better for them. Low & No (+39%) - Most Low & No options were still seen as a compromise in terms of taste and refreshment before 2016, but consumers were actively looking for lighter alternatives to enjoy social rituals without the side effects. Health & Calories (+18%) - Health-conscious drinkers were increasingly interested in what goes into their bodies and looking for low and sugar-free options. The appeal of a ready-to-drink containing less than 99 calories was strong. Natural Alternatives (+42%) – Discerning consumers were actively talking about products that contain fake flavours and synthetic sugars. They wanted natural and real ingredients.

Hard Seltzers were predictable!

By analysing the key drivers of online conversation prior to 2017, it’s easy to see that the Hard Seltzer category was ready to take-off. The needs were present and rapidly growing. The emergence of Hard Seltzer was indeed predictable! Which begs the question: what was the value of this data to the major alcohol industry players at that moment in time? Would a client of Black Swan’s have been able to replicate the success of White Claw? No one will ever know. But brands with access to this data would have had the strategic insights and building blocks to create a new Hard Seltzer proposition. Clearly, the clever folks at White Claw and Truly did a fantastic job of tapping into nascent consumer needs and translating them into a winning product and marketing mix. Hats off to Mark Anthony Brands and Boston Beer!

So that’s the past, but what’s next?

We prefer not to get too caught up in the past. After all, we’re a predictive analytics company that’s continuously developing our technology to accurately answer ‘what’s next?’. So, we used Trendscope to analyse the macro trends that originally drove the Hard Seltzer phenomenon to discover the next evolution of these drivers. Low & No: From Healthier Relaxation to Advanced Wellness The Low & No space remains the most interesting area of category innovation, and it’s in this territory that consumers are demanding more from the products they consume. Functional benefits in the form of added vitamins, nutrients, protein, and balanced energy are all growing in importance, especially if they come from natural ingredient sources, such as Ginseng, which is growing +29% YoY, and is our top ranked Ingredient trend in Spirits & Liqueurs. If we expand our view further into the Non-Alcoholic Beverage category (you’ll see why later), we anticipate the needle moving more towards Advanced Wellness in the form of Nootropic or Adaptogenic drinks. Think about Chorophyl Water as your next base for a product in this space.

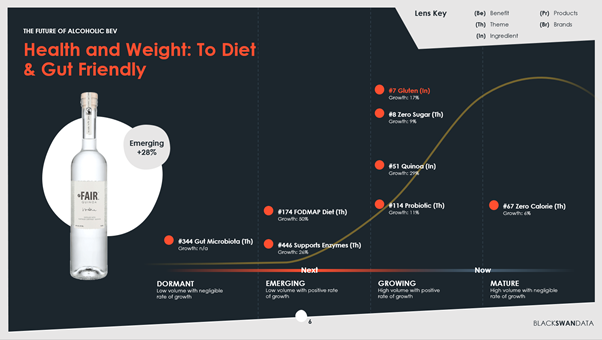

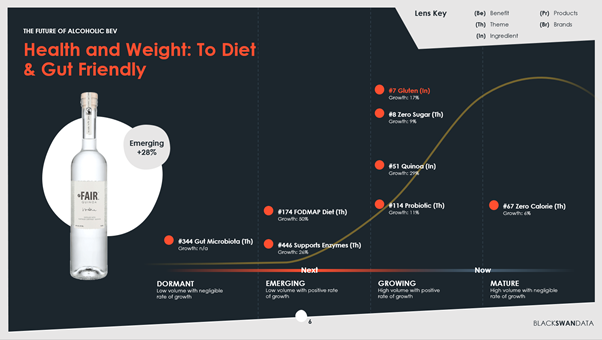

Health & Weight: Moving to Diet & Gut Friendly Health and calorie control is always going to be a core consumer need in this space. But a more nuanced and growing territory that sits beneath it is the rise of free-from and gut-friendly products that avoid bloating and help achieve a healthier microbiome. Gluten free drinks have grown +17% YoY and would be a safe bet for your next line extension. Taking it a step further, we’re seeing the emergence of conversations about low acid drinks and the FODMAP Diet (+50% YoY).

Innovative Flavours: Shifting to Process and Experience Ready-to-drink (+31% YoY) formats don’t show any signs of slowing down, but it’s time to offer consumers new experiences, and rethink how you talk about what goes into the can for today’s discerning consumers. From exploring local artisan brands to experimenting with new international flavours, more people are looking to expand their alcohol choices with novel experiences and options. Additionally, consumers are seeking out brands that align to their personal ethical beliefs, taking note of specialty ingredients, how a product is made, and a brand’s stance on issues like sustainability.

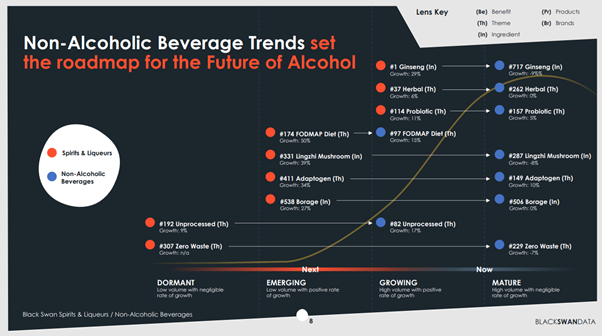

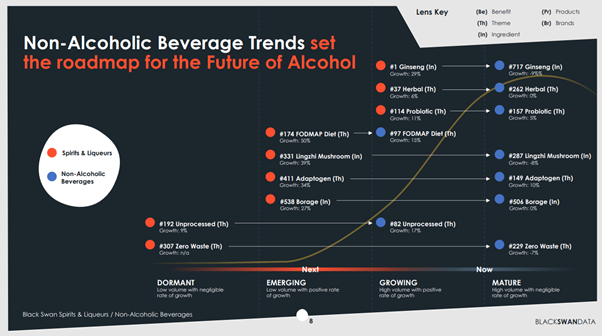

Bonus: What can we learn from Cross-Category Trends? We see this play-out time and time again, where one category acts as a bellwether for another. In this case, Non-Alcoholic Beverage (NAB) trends are a very strong predictor of what will be coming 12-18 months down the line in Alcohol. For example, Ginseng has now reached Mature status in NAB and is a large, stable, mainstream trend but is in the Growing stage of its maturity curve within Spirits & Liqueurs. Likewise, Lingzhi Mushrooms, often added to drinks like coffee to boost its health credentials, is a mature trend in NAB but Emerging in Alcoholic conversations. Espresso Mushroom Martinis anyone?

How can we help you?

Trendscope enables brands to understand what topics consumers are talking about online and predict which will sustain growth into the future with scientific accuracy. If you want to understand what’s coming round corner and predict the next Hard Seltzer breakthrough innovation of your category, then please get in touch with us at

hello@blackswan.com.