Since the beginning of market research in the early 1900’s, companies have been trying to understand the needs of their customers, find ways of improving their products, and validate new ideas before spending large amounts of money developing them.

To serve these needs, companies employed market researchers — both internally at their companies and externally via agencies, to help them find the answers to these questions. Those market researchers would use a mix of data sources and techniques — sometimes using secondary research (existing data and answers), but most often they needed to conduct primary research — that is the collection of new data that answered their unique questions via asking people questions directly. There are many methods to conduct primary research, and I discussed some of the challenges in my previous article:

Stop Asking Questions & Start Getting Answers.

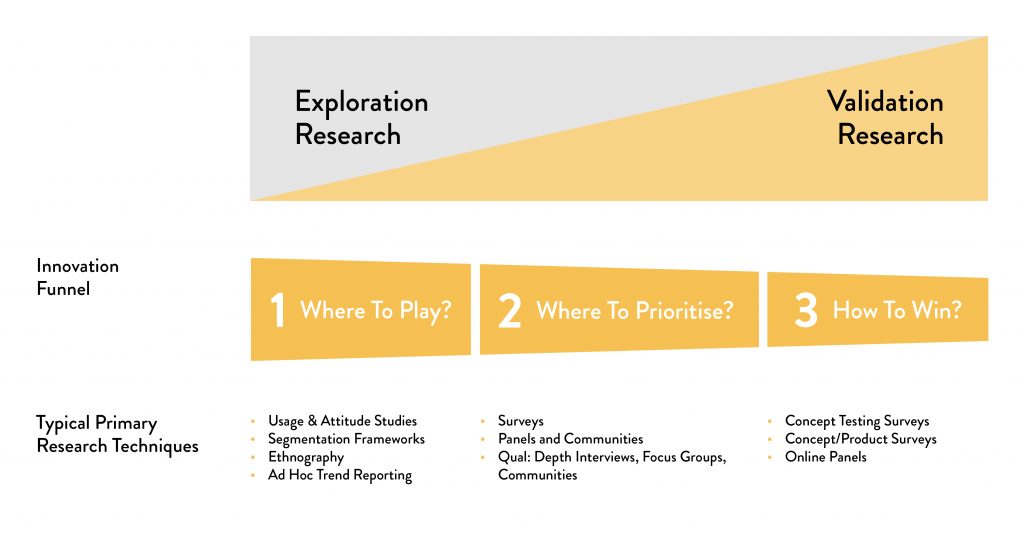

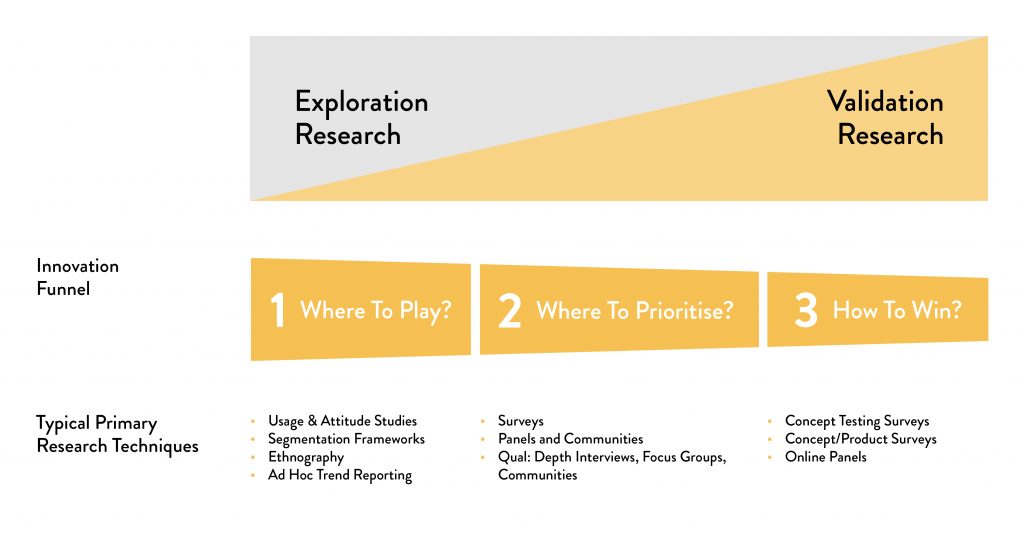

Rather than review all of the existing methods in this article, I would like to instead propose a vision for the near future. A future that is already possible today — and one I believe will become the reality sooner than we think. That vision — is the death of primary research. By which I mean no longer will companies use ANY form of direct questioning of consumers to answer their business questions. They will still get the answers they need — they will just get them via a different method which I will outlay here. A vision for a questionless world. If we boil down the types of questions businesses usually try to answer using market research, they fall into 2 broad camps — Exploration and Validation.

Exploration Questions in this camp are all about discovery and strategy. What is possible? What needs do consumers have? What are other companies doing in this space? What new products are consumers talking about? What do consumers think of when they think of my brand? Where should I position my brand? What white spaces exist? This phase is all about understanding and opening up possibilities, broadening the horizons of the decision maker (usually a brand manager or product manager), providing inspiration and evidence for new ideas, and helping create and define a strategic direction. Many primary research techniques exist in this space, from focus groups and ethnographies, to online communities, to large scale survey based demand space segmentations and U&A studies. Most of the methodological innovation in this area over the past 20 years has been to lower costs by moving survey collection online, and the introduction of more advanced statistical techniques like

Hierarchical Bayes for segmentation.

However while the traditional primary research techniques will seek to further reduce cost through automation, I would argue this is a false economy. The issues outlined

here still exist — even if you get those answers cheaper and faster than before.

Instead, we should be seeking to get our answers without asking a direct question by instead mining the massive amount of online data already available. Nearly every business question that exists has already been talked about by someone, somewhere, in an unprompted context. My two favourite relevant quotes here are: “The future is already here, it’s just not evenly distributed.” — William Gibson “Your brand is what people say about you when you’re not in the room.” — Jeff Bezos There is a growing number of vendors who enable companies to get the answers they need in this space without asking questions. Discover.ai, Tastewise, Sparks & Honey, Motivbase, and of course our own Black Swan Data to name a few. Innovation in this space will continue and as people continue to add public content or anonymised content onto the internet, the Data Science techniques now in use and being developed will enable all of the use cases in the Explore phase to be answered faster, in more depth, and with greater predictive accuracy than any of the existing direct questioning primary research methods.

Validation This second phase is all about confirming that the idea a company has will resonate with their customers. The idea could be anything — a new marketing campaign, a new price point, a new pack design, or a whole new product range. The goal of using primary research in this phase is to both optimise the idea and most importantly to reduce risk by getting an early read of potential in-market performance — before the idea is launched.

The goal here is to be predictive — ie if company A launches idea B, what will happen? How much will it sell? While this has always been the goal, the reality is that very few of the existing primary research techniques are effective at predicting how consumers will react when the idea is finally launched. There are many reasons why traditional primary research techniques and some non traditional (EEG testing, facial coding, etc) have struggled to be effective predictors of in market reality. Two of the biggest are 1) over-sensitisation to the test stimulus, and 2) lack of full purchase context.

Both of these issues are now technically viable to solve, enabling the second key development in the plot to kill primary research — direct experimentation. Don’t ask questions, just test your idea in a live environment and see how customers react! A decade ago this option wasn’t really viable, because for many categories consumers did little to no shopping online in their daily lives. Few people bought soda, or chips, or mayonnaise, or fresh meat online.

Yet a decade on a large and growing portion of all retail shopping is online, and even in CPG many consumers are used to navigating shops like Ocado or Target online to do their weekly grocery shop. The pandemic has massively accelerated this shift in consumer behaviour — to the point where nearly

20% of all grocery sales will be made online by 2024. This means now that the ultimate flexible experimentation tool — online shopping — can be applied to nearly every product category imaginable. I am not an expert in the logistics of online retail, so if there are people who read this who are, I’d love to know if this idea is feasible or not — but imagine this: a manufacturer wants to launch a new line of snacks but doesn’t know which flavours to launch, or which pack design to go with. Instead of trying to answer those questions using a survey — instead they create a digital mock up of each option — and then either on their own retail site or that of an online partner, they randomly select which shoppers see which version of the new product, and place it on the site with all of the rest of their normal shopping just like it would be if they launched it for real.

Then, if it was a concept only idea, if a shopper added it to their basket, they could just get a simple message saying that product has just gone out of stock. The experiment would record it as a sale, but no product would need to be made or shipped. Or taking it further — you could even do a concept / product test if you had test product, and ship the product to those customers — and allow them to see it online when they return to shop again, and see if they would buy it again.

In this way not only would you get results that are likely to be far more reliably predictive (as they happened in context with real shoppers) but also those retail sites have a far more detailed profile of who the shoppers who purchased (and didn’t purchase) your new product idea are — a detailed picture that is built on actual not claimed behaviour.

The reign of primary research has been long, and has done a lot to improve company’s decision making over the last 100 years. But it’s time for a new era of research tools that are faster, more comprehensive, and most importantly — more predictive.

The King is Dead. Love live the King!

Dave Soderberg is Black Swan Data’s Chief Data Officer. Prior to working at Black Swan, Dave spent over a dozen years working in agency and client-side market research roles for PepsiCo, Spectrum Health and BASES. To talk to Dave or a member of the team please contact us at

hello@blackswan.com. October 2021