We’ve recently launched Trendscope

™ 3.0 – the newest version of our trend prediction tool. Trendscope

™3.0 brings a host of new features, and I’m going to dive into one of them here: our new Beta feature Dynamic Trend Clustering.

Say you’re building a beverage product that has a weight loss benefit. Wouldn’t it be good to know the ingredients that consumers talk about in conjunction with weight loss? Like Green Coffee Bean? A Trend Cluster can do this, allowing you to easily see not just the benefit trend, but also which ingredients might best provide a strong reason to believe for that benefit.

What exactly are Trend Clusters?

To understand Trend Clusters, we first need to look at Trendscope

™. Using our Trend Prediction Value (TPV) algorithm, Trendscope

™scientifically identifies and contextualises every trend relevant to your business. Over 3,500 market trends per category, in fact.

So, if an ingredient, product, brand, benefit or theme is being discussed online, Trendscope

™will analyse, rank and predict its future importance to your category.

Trendscope

™gives a level of granularity that’s unparalleled to any other tool on the market. It brings clarity about what consumers are talking about in the context of your category and helps you know what to act on and importantly, what to avoid.

With Trend Clusters we’re stepping up a level from granular trends. By using a Network-based AI approach, Trendscope

™now dynamically clusters all of the trends we track into 200-400 higher level Trend Clusters per category and market.

These clusters span multiple trend types. Some clusters are formed from just one trend type – for example, all of the Tea products together. You can think of these clusters as ‘Navigational’, in that they mainly help you simplify all of the thousands of trends into groupings of similar items.

Other clusters have multiple types of trends contained in the same cluster. Like the weight loss example previously mentioned. These trends are more revelationary in nature. Having a combination of two different types of trends can tell you something about each that you wouldn’t know without seeing them in the same cluster.

Not only do we show you all of the trends that make up each Trend Cluster, we can also calculate aggregate Trend Prediction Value (TPV) scores for the cluster. This allows you to see which cluster is likely to grow in the future, as well as how each trend within the cluster is performing individually.

How are Trend Clusters created?

It all starts with Associations. Our Lift metric for Associations shows how two trends are related, based on how people talk about those topics online. If the Lift is closer to 100%, then those two trends are

alwaystalked about together. But as the Lift gets closer to 0%, either the two trends are never talked about together or are only talked together by chance. Lift is a metric used in Market Basket Analysis – the difference here is that the ‘basket’ is a document, like a news article or a tweet.

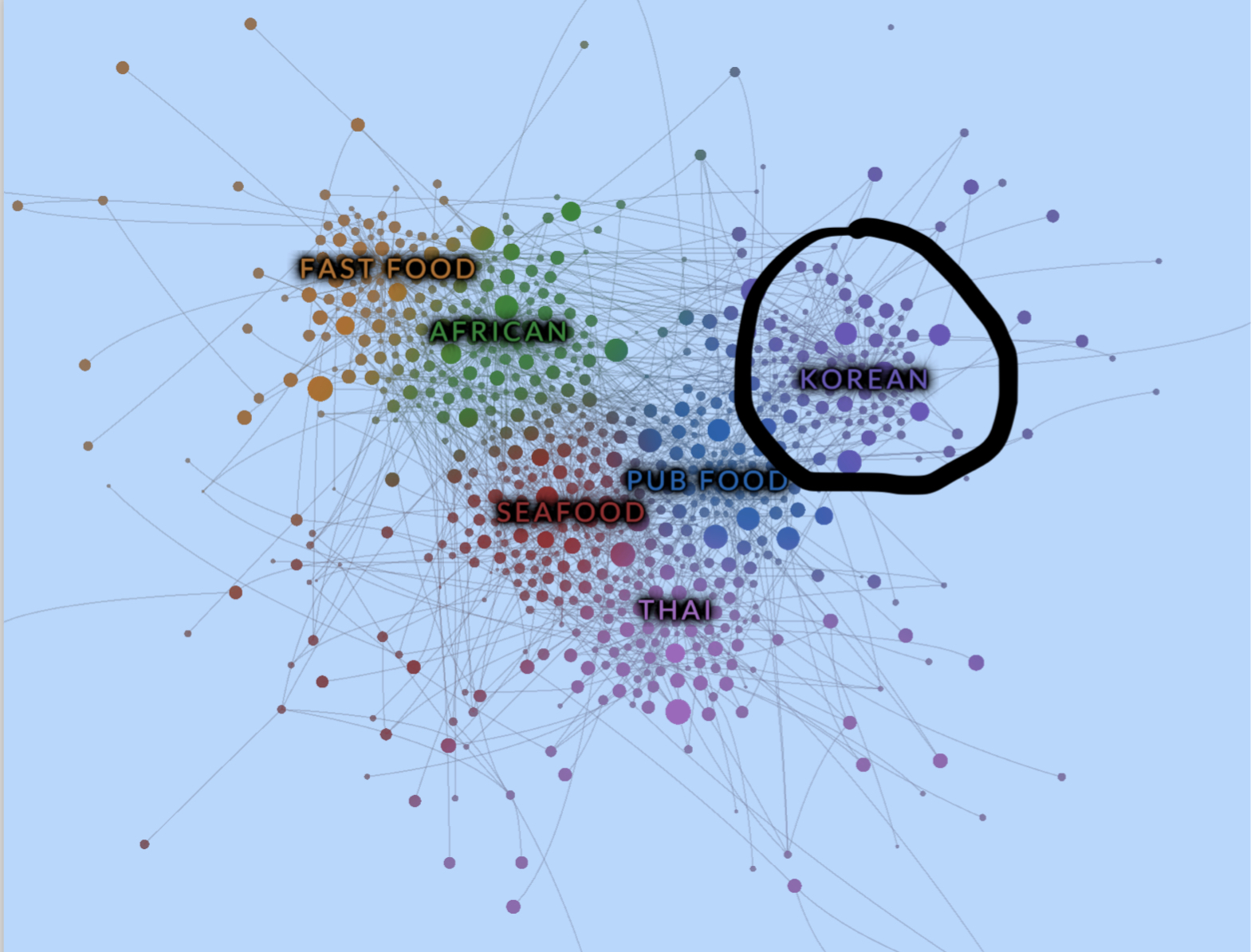

Taking this Association data we then build a Trend Graph Network. Each trend becomes a node on the graph, and the links between the nodes are based on the Association metric. From this, we can then use Network AI to find where clusters of Trends automatically form.

The results

Our Insights teams review the 200-400 Trend Clusters and give them names we can all understand. Names like Aromatic Teas, Anti-Arthritic Ingredients and Ketogenic Products. It’s important to remember that Trend Clusters exist in a context. In our case, the context of a specific category and market, like US Non-Alchoholic Beverages, or UK Spirits & Liqueurs.

Once a Trend Cluster is created, we calculate some aggregate metrics for each cluster. This includes a TPV ranking and the maturity phase of the cluster itself, which is calculated by taking the median TPV value for each trend within the cluster.

We can also look at how brands are associated with each Trend Cluster, giving brand owners a better understanding of how their brands are positioned in the market today.

What does it mean for brands and businesses?

Having a higher level view of the topics that are shaping and driving your category means you’ll see how consumers are naturally talking about them, instead of using an existing trends framework.

On an innovation level, you can explore which granular trend manifestations are directly influencing high-level category trends (and vice-versa). This can be leveraged in your business to build more relevant product concepts.

TPV ranks all Trend Clusters by their predicted importance six months or more ahead. Plus the Network analysis identifies the underlying association and links between seemingly disparate trends much earlier than traditional research methods.

Ultimately, armed with unprecedented early trend intelligence gives you thecompetitive advantage to get to market first.

This new beta feature shows real promise to help you understand your market in a way that’s never been possible before. We are continuing to evolve and improve our clustering approach and look forward to partnering with leading Insights teams to deliver this exciting new Insight tool.

Want to find out more about Trendscope

™3.0?

Get in touch with the team to request a demo.